Lookinglass

Digital insurance products SaaS

The Problem

In the complex landscape of insurance, companies often grapple with an array of formidable challenges that span operational, strategic, and customer-centric domains. These challenges include:

Manual Processes:

Traditional insurance operations often rely on labor-intensive and time-consuming processes, leading to inefficiencies, delays, and heightened operational costs.

Fraud Detection:

The relentless battle against fraudulent claims demands substantial resources and sophisticated tools to effectively distinguish genuine claims from deceptive ones.

Customer Engagement:

Engaging customers throughout the policy lifecycle can be a Herculean task. Achieving personalized interactions, swift responses, and consistently positive customer experiences is paramount.

Underwriting Accuracy:

Accurately assessing risks during underwriting is a linchpin of successful insurance operations. Errors in risk assessment can result in underpriced policies, leading to financial losses, or overpriced policies that deter potential customers.

Claims Processing Delays:

Languid claims processing can exasperate policyholders and erode an insurer's reputation. Streamlining claims assessment and approval is crucial to maintain high levels of customer satisfaction.

Data Management:

The insurance industry generates vast volumes of data. Effectively handling, analyzing, and extracting actionable insights from this data is a multifaceted and resource-intensive endeavor.

Regulatory Compliance:

The intricate and ever-changing regulatory landscape adds an additional layer of complexity to insurance operations, demanding meticulous attention to legal and compliance matters.

Market Competition:

The intense competition within the insurance sector necessitates constant innovation to distinguish offerings, capture market share, and remain at the forefront of the industry.

Risk Management:

Striking a delicate balance between a company's risk appetite and the imperative to provide comprehensive coverage to policyholders is an ongoing challenge.

Legacy Systems:

Many insurers grapple with outdated legacy technology systems that hinder agility, innovation, and integration with modern tools, hindering their ability to adapt and evolve in a rapidly evolving landscape.

To confront these challenges head-on, a well-designed insurtech solution emerges as a potent ally.

Harnessing cutting-edge technologies like generative AI, such a solution empowers insurers with the tools needed to enhance operational efficiency, improve accuracy in risk assessment, streamline claims processing, bolster customer engagement, navigate regulatory complexities, and stand out in a fiercely competitive marketplace. In an industry poised for transformative change, embracing insurtech is pivotal for insurers seeking to thrive and lead in the modern insurance landscape.

Our Services

Our building blocks, Lookinglass and Unicorn, form the cornerstone of our commitment to excellence.

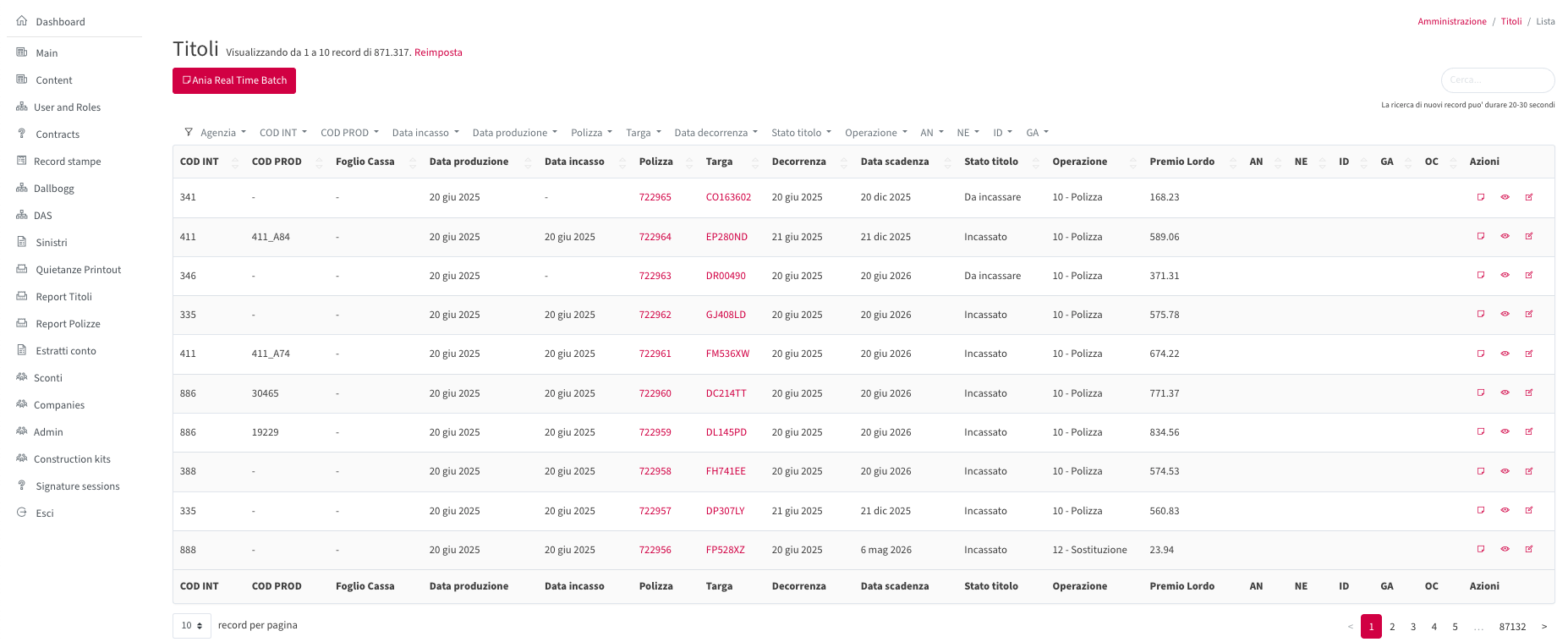

Lookinglass

Lookinglass serves as our primary intermediaries' browser-based frontend, providing a vital bridge for seamless integration between our expansive sales network and third-party insurance services. This interface empowers us to deliver innovative sales strategies, linking our sales logic with external insurance service providers, thus ensuring a holistic approach to insurance sales.

Unicorn

Unicorn takes center stage as the foundational service at the heart of our insurance operations. With robust integrations already in place, Unicorn harmonizes effortlessly with ANIA and various third-party services, establishing a well-entrenched framework tailored to the unique demands of the Italian insurance market. This framework ensures that we enter the market with a fully operational platform ready for action.

How we orchestrate

everything

An architectural ethos revolving around a service-based model, where each component plays a pivotal role in orchestrating the complete insurance lifecycle, from product inception to claims resolution.